Required minimum distribution 2021 calculator

Or you can wait and take it in the next year. Use this calculator to determine your required minimum distributions RMD from a traditional IRAThe SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July 1.

Ira Withdrawal Calculator Shop 70 Off Avifauna Cz

Your second and all subsequent distributions must be taken.

. Required minimum distributions RMDs are withdrawals that you must take from your IRA or 401k after you reach a certain age. 2021-2022 Tax Brackets. The table below shows the top 3 tax expenditures.

For those who are married and filing. The threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021 for those filing as single or head-of-household. Many stats calculators December 5th 2014.

They prevent the tax advantages of these accounts from being passed on to your heirs. To figure out your RMD for this and future years use our RMD calculator. Most annuity companies recognize this unique scenario and will waive surrender charges if the RMD amount is larger than the penalty-free withdrawal.

The sample below shows required withdrawals per 100000 by age based on 2022 IRS tables. If you turn age 72 or retire and youre already age 72 or over or were age 70½ or older on December 31 2019 in the first year for which you are required to take RMD you have two choices. If you were born on or after July 1 1949 your first would have been required by April 1 2021.

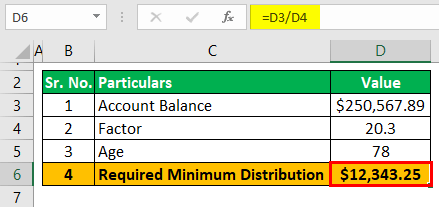

This amount also known as your Required Minimum Distribution RMD is determined by your age and account balance so it changes each year. After long working hours Ive finished all the solvers required to cover all basic statistics topics. For example if you take a distribution in 2022 use the age you become on your birthday in 2022.

This calculator has been updated for the SECURE Act of 2019 and CARES Act of 2020. Your first required minimum distribution is due by April 1 of the year after you turn 72 70 12 if you were born before July 1 1949. 1970 to December 31 st 2021 the.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. Although you cant roll. However IRS guidance clarified that the April 1 2020 distribution has also been waived.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. The SECURE Act changed the age at which an RMD is required to start to age 72. The analysis provided by this tool is based solely on the information provided by you.

In July 2033 your income will fall below the minimum threshold. You may wonder Can I reinvest my required minimum distribution. RMDs ensure that the IRS receives its tax money.

If you do not want to take your RMD because you dont need the income theres good news. You generally have to start taking withdrawals from your IRA SEP IRA SIMPLE IRA or retirement plan account when you reach age 72 70 ½ if you reach 70 ½ before January 1 2020. Minimum Sample Size December 7th 2014.

Consequence for failing to take required minimum distributions If you do not take any distributions or if the distributions are not large enough you may have to pay a 50 excise tax on the amount not distributed as required. Based on your income tax of 11067 the amount of the expences is relative to your contribution. You can take your first withdrawal the amount required for the first year in that year eg 2021.

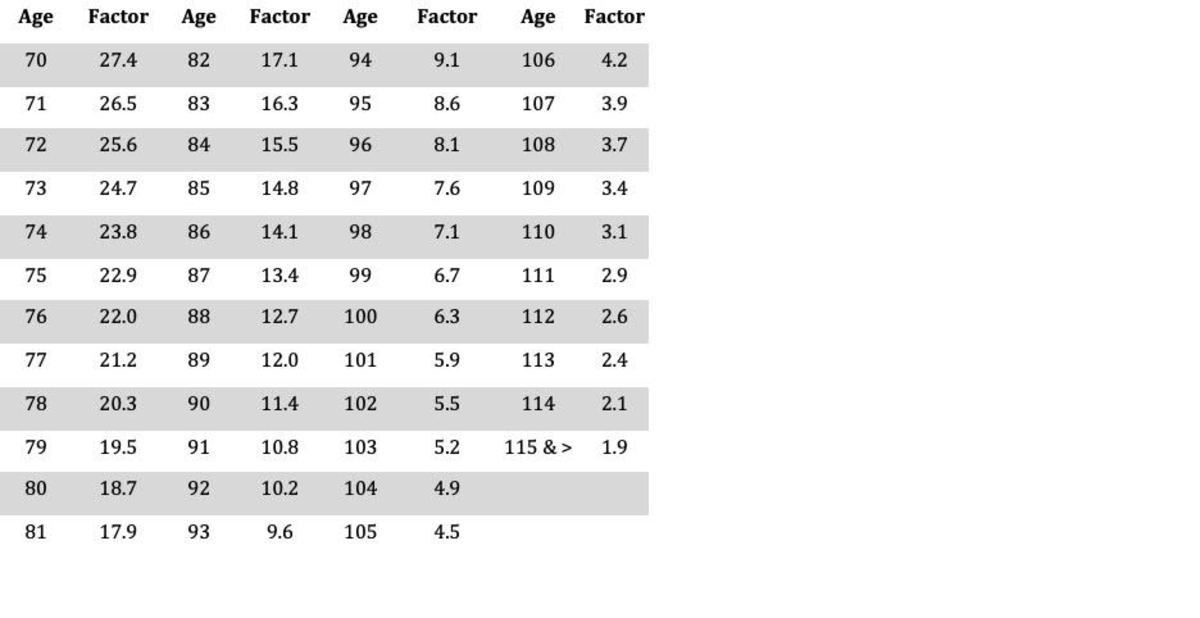

Single Life Expectancy. The deadline for your first RMD is April 1 but all subsequent RMDs are due December 31. The required minimum distribution table rmd table for those who reach age 70 and the rmd table for beneficiaries are printed below.

The required minimum distribution RMD rules limit the extent to which an individual can use the tax deferral of an IRA or other qualified retirement plan. Use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. Once you turn 72 you must begin withdrawing a set amount each year called a required minimum distribution whether you need the income or not.

The percentage of the retirement account that must be distributed each year is not fixed. The RMD tables changed starting in 2022. You can withdraw more than the required amount in any year just not less.

The RMD rules dictate when distributions must be made from the retirement plans of certain taxpayers. If this is a year you need to take an RMD read on for some suggestions on how you can potentially use the money. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

The distributions are required to start when you turn age 72 or 70 12 if you were born before 711949. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. If you want to download this RMD table for an Excel spreadsheet just highlight and copy the table and then in your spreadsheet select paste special and unicode text.

Budgeting Calculator Financial Planning Managing Your Debt Best Budgeting Apps Investing. Sometimes the surrender charge period coincides with an annuity owners required minimum distribution period. Youre not required to take RMDs from Roth IRAs.

I have added a minimum sample size calculator for mean and proportion. Therefore if you turn 72 in 2021 wait until March 31 2022 to make your first RMD youll have to take another RMD in December 2022. Simple calculator for Australian income tax.

Paul must receive his 2022 required minimum distribution by December 31 2022 based on his 2021 year-end balance. Which can be obtained by calling 18003452021 contains this and.

Rmd Table Rules Requirements By Account Type

New Guidelines For Your Required Minimum Distributions Rmd Coming In 2022 Paul R Ried Financial Group Llc

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Required Minimum Distribution Calculator Estimate Minimum Amount

Rmd Calculator Required Minimum Distributions Calculator

How To Calculate Rmds Forbes Advisor

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Ira Withdrawal Calculator Shop 70 Off Avifauna Cz

Required Minimum Distribution Calculator Estimate Minimum Amount

Ira Withdrawal Calculator Shop 70 Off Avifauna Cz

2022 New Irs Required Minimum Distribution Rmd Tables

Rmd Table Rules Requirements By Account Type

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Where Are Those New Rmd Tables For 2022

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Required Minimum Distribution Calculator Estimate Minimum Amount